Anhydrous, DAP Lead Retail Fertilizer Prices Higher

Retail fertilizer prices continued to be mixed for the first week of October 2025. Prices for four of the eight major fertilizers were up from last month while prices for the other four were down. Two fertilizers, anhydrous and DAP, had significant price increases.

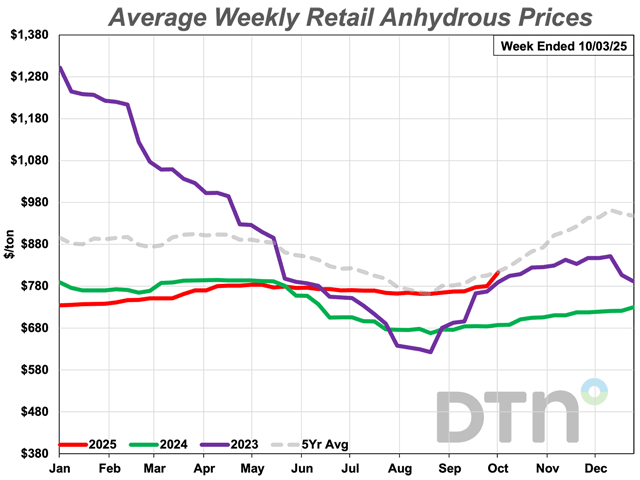

The average retail price of anhydrous during the first week of October was $813 per ton, up 6% from last month. Anhydrous is now 18% more expensive than it was a year ago. (DTN chart)

OMAHA (DTN) — Average retail prices for half of the eight major fertilizers were higher than last month, while prices for the other half were lower during the first week of October 2025, according to sellers surveyed by DTN.

Of the four fertilizers with higher prices, two were up substantially, which DTN designates as anything 5% or more.

Anhydrous was 6% higher compared to last month with an average retail price of $813 per ton. Anhydrous was over the $800/ton level for the first time since the third week of December 2023. That week, the price was $807/ton.

DAP was 5% more expensive compared to last month with an average price of $906/ton during the first week of October.

Two other fertilizers had slightly higher prices. MAP had an average price of $921/ton and UAN28 $419/ton.

The remaining four fertilizers were slightly lower in price from last month. Potash had an average price of $483/ton, urea $609/ton, 10-34-0 $666/ton and UAN32 $465/ton.

On a price per pound of nitrogen basis, the average urea price was $0.66/lb.N, anhydrous $0.50/lb.N, UAN28 $0.75/lb.N and UAN32 $0.73/lb.N.

The European Union’s (EU) carbon border tax could raise fertilizer import costs in 2026. According to a recent Rabobank report, the EU is set to introduce a carbon tax on 15 million metric tons (mmt) of nitrogen-containing imports into the EU, which will affect import costs.

The estimated price increase in 2026 will range from 10% to 20% for ammonia, 10% to 15% for urea, and 2% to 5% for DAP, depending on supplier emissions. These increases could rise to 50%, 45% and 10%, respectively, by 2030 as free allowance under EU’s Emission Trading System (EU ETS) is phased out and carbon prices climb.

Rabobank reported that high-emission suppliers such as Trinidad and Tobago and China will face steep liabilities, reducing their competitiveness. Lower-emission producers like the U.S. are expected to gain market share.

“U.S. trade policy and EU tariffs on Russian fertilizers will further accelerate sourcing shifts,” the report said.

All eight fertilizers are now higher in price compared to one year earlier.

The last holdout, potash, is now 7% higher. 10-34-0 is 13% more expensive, MAP is 15% higher, anhydrous is 18% more expensive, DAP is 23% higher, urea is 26% more expensive, UAN28 is 32% higher and UAN32 is 33% more expensive looking back to last year.

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/agriculture/web/ag/markets/fuels-fertilizers#!/fertilizers.

DAP led fertilizer prices higher in the fourth week of September 2025. You can read about it here: https://www.dtnpf.com/agriculture/web/ag/crops/article/2025/10/01/dap-leads-fertilizer-prices-higher.

| DRY | ||||

| Date Range | DAP | MAP | POTASH | UREA |

| Sep 30-Oct 4 2024 | 736 | 805 | 449 | 485 |

| Oct 28-Nov 1 2024 | 739 | 810 | 446 | 497 |

| Nov 25-29 2024 | 740 | 811 | 443 | 498 |

| Dec 23-27 2024 | 739 | 810 | 444 | 489 |

| Jan 20-24 2025 | 739 | 809 | 443 | 492 |

| Feb 17-21 2025 | 762 | 809 | 444 | 543 |

| Mar 17-21 2025 | 766 | 810 | 454 | 556 |

| Apr 14-18 2025 | 781 | 822 | 467 | 577 |

| May 12-16 2025 | 794 | 825 | 469 | 630 |

| June 9-13 2025 | 805 | 832 | 474 | 656 |

| July 7-11 2025 | 810 | 847 | 481 | 658 |

| Aug 4-8 2025 | 822 | 892 | 484 | 646 |

| Sep 1-5 2025 | 860 | 913 | 487 | 632 |

| Sep 29-Oct 3 2025 | 906 | 921 | 483 | 609 |

| LIQUID | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

| Sep 30-Oct 4 2024 | 590 | 687 | 317 | 350 |

| Oct 28-Nov 1 2024 | 604 | 706 | 317 | 363 |

| Nov 25-29 2024 | 611 | 718 | 323 | 364 |

| Dec 23-27 2024 | 614 | 729 | 326 | 365 |

| Jan 20-24 2025 | 616 | 737 | 326 | 367 |

| Feb 17-21 2025 | 638 | 747 | 348 | 394 |

| Mar 17-21 2025 | 649 | 761 | 356 | 412 |

| Apr 14-18 2025 | 656 | 781 | 380 | 448 |

| May 12-16 2025 | 666 | 777 | 412 | 484 |

| June 9-13 2025 | 669 | 773 | 418 | 495 |

| July 7-11 2025 | 672 | 769 | 417 | 501 |

| Aug 4-8 2025 | 669 | 765 | 421 | 498 |

| Sep 1-5 2025 | 667 | 767 | 415 | 481 |

| Sep 29-Oct 3 2025 | 666 | 813 | 419 | 465 |

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on social platform X @RussQuinnDTN

(c) Copyright 2025 DTN, LLC. All rights reserved.