Gulke: Decision Time: Sell or Store?

The views expressed are those of the individual author and not necessarily those of DTN, its management or employees.

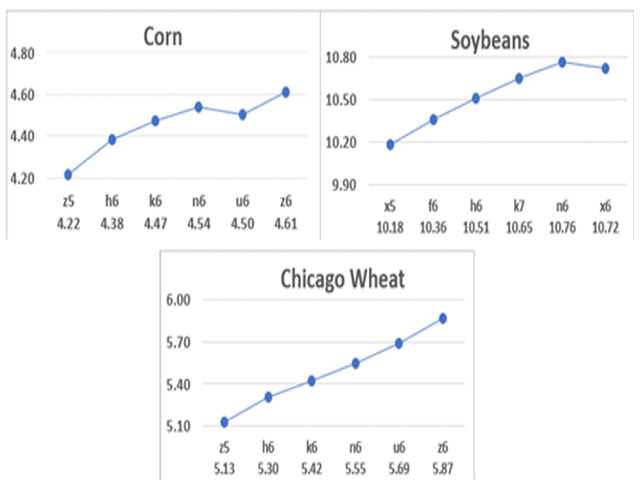

Charts showing cost of carry from one month to the next. (Source: Philips Analytics)

The government shutdown has created an info void for some, it seems, especially affecting the talking points in the media. It is as if there is a loss of opinion without information — especially for those who are data-driven. It is likely we will not get an October WASDE report this week, as well as missing weekly export sales reports and the CFTC reports. I watch the large spec net position with interest. However, to be honest, I haven’t missed the data yet.

For the first time in a long while, it feels like we are closer to a level playing field with those who use algorithms or government-speak to influence their outlook and trading. How we allowed nanosecond trading to enter our world of price discovery is beyond me — except that it created volume, which equates to money. Whether it is beneficial or not is subject to debate.

For me, this lack of data-driven influence places even more importance on price-activity (price charts) and price volatility and volume. Increased uncertainty has likely caused some withdrawal of trading — by traders in general and speculators in particular. This, in turn, has yielded opportunities we need to consider when deciding whether to hold (store) or fold (sell) our unsold production as harvest quickly evolves.

I have discussed what seemed to me like excessive storage charges for those who had to deliver grain off the combine with the decision to just dump the grains or store for the carry. The chart accompanying this column is of the carry from one month to another of futures prices. (Source: Philips Analytics) I’ve written about the dilemma before, but the general commercial storage schemes don’t pencil out.

For example, storage for soybeans in my area is about 41 cents from fall harvest (October) to March 1, 2026. The futures market from SX to SH is 31 cents, yet the cash bid for March 1 is about 13 cents more than selling off the combine — or a built-in 28-cent-per-bushel ($18-per-acre) loss. Not even the futures carry is passed on with a poor bid explained by citing the ecopolitical situation. China is the culprit and no deal yet! The bottom line says the producer shoulders the risk; artificial it seems.

The alternative, if that is your choice, is to re-own on paper using call options. For example, an at-the-money March soybean call option is trading ironically for about 37 cents — a little less than commercial storage. The big difference is a call option is instantaneously saleable. Storage costs are paid and not refundable. There are various schemes, including drop charges, minimum storage with daily after that, but they all amount to about the same poor return on investment.

From my perspective, I think that by the release of the Nov. 10 WASDE, we will have a government open again; we’d better. So, a December call option that expires 10 days after the November WASDE covers the time I need. If the November WASDE holds surprises — as I suspect it will — the cost of a December $10.40 call option is about 20 cents, is marketable (buy, sell) and about half of the cost of the March option.

By selling my unsold/excess harvested inventory and replacing it with long paper, I avoid the hassle of trying to justify the commercial storage scheme. By mid-November, I’ll also analyze the reaction of the market to the government paying farmers for what appears to be a safety net for potential failures of ag benefits from a China deal gone awry.

This same analogy works for corn, as well, and I will likely do the same scenario pending market developments in the next week or two. Corn is not mentioned in any recent soybean payment talks. The media thinks farmers will hold off selling commodities if paid a subsistence amount, hoping for a double-dipping of reparations for a delayed China deal and then for China to push soybean prices higher after a deal. The worst case would be to pay storage with the government payment and see a tariff deal fail. Similarly, while on-farm storage has more benefits, watching and waiting without a plan to manage price risk could be equally disappointing.

I hope this helps with your decision-making in these questionable times. It is rare that we find ourselves benefiting from trader confusion, uncertainty and clarity. A good time to act! Do your due diligence!

Jerry Gulke can be reached at (707) 365-0601 or by email at Jerry@gulkegroup.com

(c) Copyright 2025 DTN, LLC. All rights reserved.