Gulke: Herd Mentality

The views expressed are those of the individual author and not necessarily those of DTN, its management or employees.

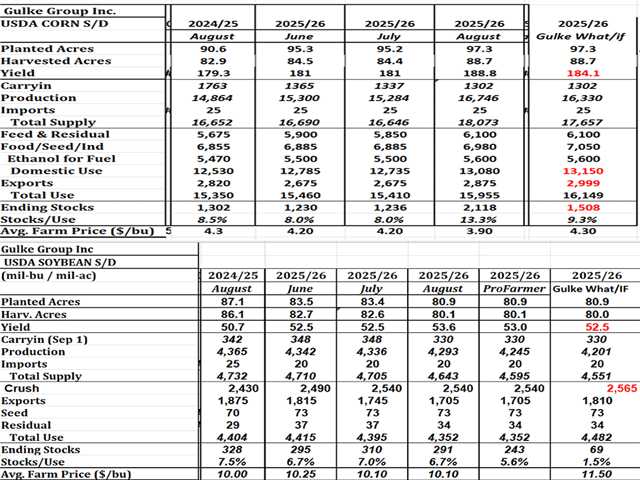

[(Tables by Gulke Group)]

Gulke: Herd Mentality

I am not going to sound like a broken record regarding past discussions on price discovery. But to reiterate — the herd mentality I have seen and heard regarding what an awesome supply we had developing is disturbing. A lot of media, brokers, analysts have been drinking that Kool-Aid. But I was not one who lost sight of demand and expressed it for months, as far back as 18 months ago.

— Eighteen months ago, USDA/NASS underestimated demand for 2024-25 by nearly 900 million bushels (mb). Ending Aug. 31 at 1.302 billion bushels (bb), not 2.1 bb or the 1.410 bb I suggested 18 months ago. Simple math will show the loss of potential income.

— The stocks in all positions on June 30, 2025, were said to be 47% less than a year ago. My 10-year-old grandson, Foxy, can do that math and make a conclusion; not the preharvest pressure to sell on-farm corn, thus a near-30-cent rally since Aug. 12.

— The harvest lows were said to be behind us in my column much earlier than Aug. 12.

— Technical signals predicted long ago what is transpiring the last two weeks and as we begin September with a new week, month and quarter of trading the 2025-26 marketing year.

— Yet the herd mentality including observations at the Farm Progress Show and to begin this week were of one accord. I was interviewed by three Midwest radios stations last Friday and the first question of all three was, “Jerry, what are we going to do with all the corn and beans?” I felt this gave not seeing the forest (demand) for the trees (supply) a whole new meaning.

Using some “what ifs” with reality as it is perceived today, the tables accompanying this column show what the ending stocks do with some minor changes, most of which have antidotal evidence of evolving over time. The crop ratings reflect what I say.

Corn rated good to excellent was down 2% with soybean good to excellent down 4%. Some private indexes show conditions rolling over rather sharply compared to previous week. Whatever the case, this time of the year ratings rarely reverse higher but continue to deteriorate. Weather suggests that is the case this year.

A cursory look at the supply and demand tables says it better than I can and rather than beat a good horse to death, it is very simple to see we are approaching the edge where rather than having too much of everything, we are close to having barely enough IF the demand doesn’t change. So far demand has trended on the chart from the lower left to the upper right (increasing) for corn in a tangible manner, with soybeans less so.

The walking hand in hand by China, India and Russia was meant to be an “in your face Trump” signal. It could get real interesting in the next week as the Supreme Court may have to step in on tariffs and maybe, just maybe, someone in the administration turns loose biofuels before harvest, which is what they should have done months ago.

Based on prior research and Gulke Group intelligence, we have had NO corn hedges and about 50% of hedges since late July prior to Aug. 12. In fact, there have been stabs at going long on paper just to test theory. So far, it appears old age and wisdom will win out over beauty, youth and inexperience once again as we enter a period that has media like deer in the headlights not seeing the forest for the trees.

Jerry Gulke can be reached at (707) 365-0601 or by email at Jerry@gulkegroup.com

(c) Copyright 2025 DTN, LLC. All rights reserved.