What is AG policy regarding upcoming sesason

What is Lorem ipsum

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

With great power comes greatest responsibility

2022-23: Sold the second 25% of 2022 soybean production Dec. 15, 2022, for delivery in May. May soybeans were priced near $14.79.

2022-23: Sold the first 25% of 2022 soybean production Dec. 9, 2022, for delivery in May. May soybeans were priced near $14.94.

Average 2022-23 sale price = 75% at $14.93 (May) and 25% at $14.93 (Mar).

(Progressive Farmer image by Lisa Buser)

(Progressive Farmer image by Dave Charrlin)

CURRENT ASSESSMENT

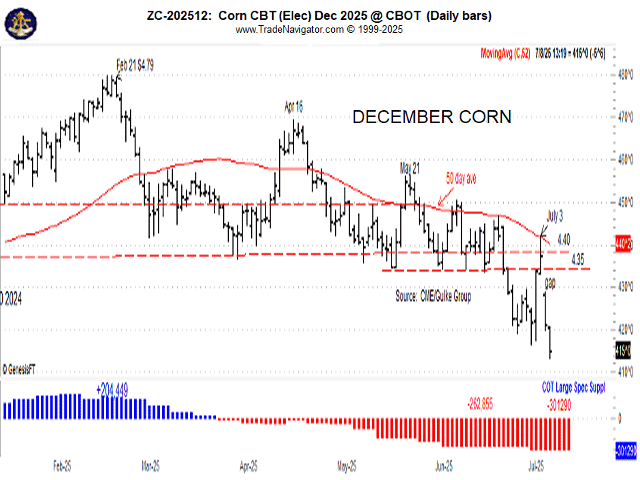

The trend for August soybean futures is sideways for now. Soybean futures collapsed to three-month lows over the most recent weeks as bearishness over the friendly growing season weather thus far and nearby forecasts, along with nervousness about new crop export demand has overwhelmed the market. The July WASDE seemed to validate the export concern as USDA reduced its 2025-26 forecast by 70 million bushels, although slightly offsetting this with a shift towards more crush. The result was a 15 mb increase to 2025-26 ending stocks but it is clear that bearish traders are currently penciling in the 5 mb production cut as temporary due to USDA’s reluctance to change yield estimates in the July WASDE. Still, soybean stocks in the U.S. are forecasted for a yearly decline for the first time since 2022-23, and the balance sheet may have to rely heavily on the record yield to keep stocks north of 300 mb. Soybeans are currently still seen as a neutral, Type 3 market.

DAILY NOTE

August soybeans traded down 3 1/4 cents on Monday to $10.01. November soybeans were down a 1/4 cent to $10.07. It was a back-and-forth session for soybeans as the market rallied off overnight lows following a weak opening Sunday evening, at one point trading over 16 cents higher than the daily low, but sellers retook control of the market by the close as nervousness remains in the market following USDA’s slightly bearish adjustments in Friday’s WASDE and a still-friendly weather forecast through July. Despite the lower close, there was a hint of optimism to be found in November futures holding above $10.00 after the trade tested a move lower Sunday night into Monday morning. $10.00 will continue to be a level to watch for the balance of trade this week. The trend for August soybeans remains sideways for now.

RECOMMENDATIONS*

(6/23/2025)

2025-26:

With November soybeans trading near 2025 highs last week but rapidly reversing off those highs, I recommend rewarding the markets rally off April lows thus far with a sale of the first 20% of new-crop soybeans. I remain cautiously optimistic regarding the soybean fundamental situation in 2025 and 2026; however, the seasonal tendency for prices to peak in summer cannot be ignored, as well as the potential for a bearish surprise in the June 30 acreage report, which further supports my belief that a sale here is appropriate. We will remain vigilant and prepared for a potential resumption of the rally to new 2025 highs. November soybean futures were near $10.55 at the time of this recommendation.