DAP Price Up 5%, Leads Half of Fertilizer Prices Higher

Average retail fertilizer prices continued to be mixed for the first week of September 2025, with prices for four of the eight major fertilizers higher and prices for four lower than last month. The price of one fertilizer, DAP, saw a significant move higher, which DTN designates as anything 5% or more.

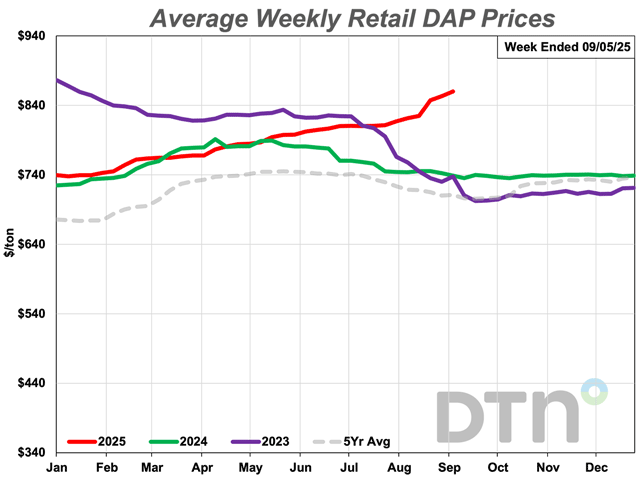

[The average retail price of DAP during the first week of September 2025 was $860 per ton, up 5% from a month ago. The price of the phosphorous fertilizer is now 16% higher than it was a year ago. (DTN chart)]

OMAHA (DTN) — Average retail fertilizer prices were evenly mixed during the first week of September 2025, with prices for half of the eight major fertilizers higher and prices for the other half lower.

For the first time in four weeks, one fertilizer saw a significant price jump from last month, which DTN designates as anything 5% or more. The average retail price of phosphorous fertilizer DAP was $860 per ton, up 5% from last month.

Three other fertilizers had slightly higher prices. MAP had an average price of $913 per ton, potash $487/ton and anhydrous $767/ton.

Prices for the remaining four fertilizers were slightly lower than last month. Urea had an average price of $632/ton, 10-34-0 $667/ton, UAN28 $415/ton and UAN32 $481/ton.

On a price per pound of nitrogen basis, the average urea price was $0.69/lb.N, anhydrous $0.47/lb.N, UAN28 $0.74/lb.N and UAN32 $0.75/lb.N.

The global supply of nitrogen, specifically UAN, is facing some major issues, according to StoneX Media Notes by Josh Linville, StoneX vice-president of fertilizers.

In the global UAN market, supply issues persist. European facilities continue to operate at 75% of normal operating capacities. Trinidad has struggled to maintain production recently, and the lingering question is when these supply concerns will reemerge there, Linville wrote.

“Russia exports remain low, as their only export option is the U.S., and they could lose access of the U.S.,” Linville wrote.”

The North American UAN market is in even worse shape, according to Linville. First, starting inventories were low for the year, and then, domestic production was slightly lower due to expected plant repairs, he wrote.

Fertilizer imports could be lower if President Donald Trump places tariffs on Russian goods, Linville wrote. Exports, meanwhile, could be higher if global supply issues persist.

In addition, nitrogen demand is expected to be high in the spring of 2026 on a large corn acreage.

“This does not guarantee supply issues as were seen this last spring, but starts the market much closer to that result,” he wrote.

All eight fertilizers are now higher in price compared to one year earlier.

The last holdout, potash, is now 1% higher. 10-34-0 is 5% more expensive, MAP is 12% higher, anhydrous is 14% more expensive, DAP is 16% higher, UAN28 is 27% more expensive, urea is 29% higher and UAN32 is 32% more expensive looking back to last year.

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/agriculture/web/ag/markets/fuels-fertilizers#!/fertilizers.

A recent article from Michigan State University Extension stated applying phosphorus when the soil test level is already high doesn’t boost yields and is bad for the environment. You can read about it here: https://www.dtnpf.com/agriculture/web/ag/crops/article/2025/09/03/mixed-prices-fertilizers.

| DRY | ||||

| Date Range | DAP | MAP | POTASH | UREA |

| Sep 2-6 2024 | 739 | 813 | 486 | 490 |

| Sep 30-Oct 4 2024 | 736 | 805 | 449 | 485 |

| Oct 28-Nov 1 2024 | 739 | 810 | 446 | 497 |

| Nov 25-29 2024 | 740 | 811 | 443 | 498 |

| Dec 23-27 2024 | 739 | 810 | 444 | 489 |

| Jan 20-24 2025 | 739 | 809 | 443 | 492 |

| Feb 17-21 2025 | 762 | 809 | 444 | 543 |

| Mar 17-21 2025 | 766 | 810 | 454 | 556 |

| Apr 14-18 2025 | 781 | 822 | 467 | 577 |

| May 12-16 2025 | 794 | 825 | 469 | 630 |

| June 9-13 2025 | 805 | 832 | 474 | 656 |

| July 7-11 2025 | 810 | 847 | 481 | 658 |

| Aug 4-8 2025 | 822 | 892 | 484 | 646 |

| Sep 1-5 2025 | 860 | 913 | 487 | 632 |

| LIQUID | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

| Sep 2-6 2024 | 638 | 676 | 327 | 364 |

| Sep 30-Oct 4 2024 | 590 | 687 | 317 | 350 |

| Oct 28-Nov 1 2024 | 604 | 706 | 317 | 363 |

| Nov 25-29 2024 | 611 | 718 | 323 | 364 |

| Dec 23-27 2024 | 614 | 729 | 326 | 365 |

| Jan 20-24 2025 | 616 | 737 | 326 | 367 |

| Feb 17-21 2025 | 638 | 747 | 348 | 394 |

| Mar 17-21 2025 | 649 | 761 | 356 | 412 |

| Apr 14-18 2025 | 656 | 781 | 380 | 448 |

| May 12-16 2025 | 666 | 777 | 412 | 484 |

| June 9-13 2025 | 669 | 773 | 418 | 495 |

| July 7-11 2025 | 672 | 769 | 417 | 501 |

| Aug 4-8 2025 | 669 | 765 | 421 | 498 |

| Sep 1-5 2025 | 667 | 767 | 415 | 481 |

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on social platform X @RussQuinnDTN

(c) Copyright 2025 DTN, LLC. All rights reserved.