Gulke: Timing Is Everything

The views expressed are those of the individual author and not necessarily those of DTN, its management or employees.

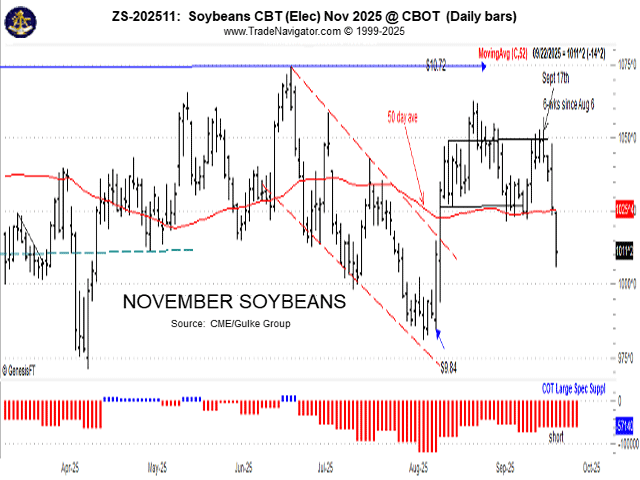

The soybean price action in this chart shows the collapse last week and drop below the 50-day average quickly trying to discover a new price due to Trump-China and Argentina selling soybeans tax-free until Nov. 1, 2025. (Chart by Gulke Group)

Soybeans have collapsed for good reasons — Trump-China and the lack of biofuels decisions — but are technically oversold heading into harvest. Are they oversold as of a week ago at $10.52? Or as of Monday on the realization that China is playing us like a fiddle, awaiting the Supreme Court decision while buying soybeans from Argentina to fill the gap until the South American harvest? This gap was filled by the U.S. last year. This action allows China to wait for Brazil’s new harvest at lower prices.

The market was flashing sell signals last week that enticed me to act on my desire not to have to sell beans out of the field below $10. After all, in the end, it will be who needs beans and who will sell them the cheapest, not who can produce the cheapest or any tariff deal proposed with China.

I don’t often like using put options, but October put options based on November futures looked cheap — even when selling well above the futures trade at that time. I had a plan in place where I had the option to take the profits and store until spring or take the money and sell out of the combine. That decision is day-to-day, as October options expire on Friday.

The assumption now has to be that China will not buy any more soybeans from the U.S. in calendar-year 2025. The flexibility of using futures and options, coupled with my belief that a six-week rally caused by weather or markets (President Donald Trump meeting with China) is long enough to discover a price representative of a best-case scenario. Technically, my studies reflected the trade was nervous and selling, and that translated into the first short-term sell signal since the buy signal prior to Aug. 12, or about six weeks ago.

Corn exhibited the same price discovery since mid-August when pre-harvest lows were posted and has maintained a 25-cent rally lasting into the six-week highs posted last week. The up-channel in corn is either a continuing pattern into the October WASDE, expecting a further reduction in U.S. yield, or a big disappointment in the October WASDE or sooner by a collapse below the uptrend, posting new lows for the week.

The soybean price action on the accompanying chart shows the collapse last week and drop below the 50-day average quickly trying to discover a new price due to Trump-China and Argentina selling soybeans tax-free until Nov. 1, 2025. A recovery is needed quickly to escape a retest of Aug. 2 lows. China buying from Argentina is signaling concerns already for 2026 fall prices, prompting some coverage there as well.

Just when things looked promising fundamentally and the media realized good demand had happened and was posted by USDA, prices paused as we harvest in earnest. Timing is everything.

Jerry Gulke can be reached at (707) 365-0601 or by email at Jerry@gulkegroup.com

(c) Copyright 2025 DTN, LLC. All rights reserved.