DTN Plains, Prairies Opening Comments

Corn and wheat markets are showing promising signs of bottoming type of action following Wednesday's reversal in corn from new contract lows yet again.

DTN Plains, Prairies Opening Comments

GENERAL COMMENTS:

Corn and wheat markets are showing promising signs of bottoming type of action following Wednesday’s reversal in corn from new contract lows yet again. It had the capitulation type of look following a $.20/bushel break in four days to start the month that likely resulted in many beaten up bulls throwing in the towel on huge (and likely unrealistic) private yield estimates. Regardless of whether it’s short covering or bargain hunting, there seems to be a bit of urgency to buy, relatively speaking of course. As damaged crop reports come in from areas that suffered drought stress in Canada for example or disease pressure and pollination issues in the Corn Belt, peak optimism on production potential may be behind us. Time will tell. In the meantime, reciprocal tariffs on many countries throughout the world took effect at midnight with the confusion over tariffs being so normalized now, markets seem to be oblivious to the risks as currencies and treasuries are quietly mixed while equities continue to rally along with energy markets.

OUTSIDE MARKETS:

Treasury markets are quietly lower following a solid recovery from steeper losses on Wednesday. The market seems to be far more worried about the weak payroll report than inflation impacts from the wide variety of tariffs. The U.S. 10-year note is at 4.24%.

The U.S. dollar is barely weaker, highlighting how confused the market has become over the net effect of the wide variety of reasons for and targets of tariffs, or by how tariffs have been normalized by now, hard to say which. The head-and-shoulders bottom formation was damaged with Wednesday’s selloff and subsequent close below support at the neckline. With it failing, the five-day surge seen last week is now presenting as a violent bear market correction with a test of new lows likely ahead. The Sept U.S. dollar is .018 lower at 97.965.

Equity markets are higher, celebrating Apple’s announcement over increased investment in America while ignoring reciprocal tariff implementations.

Energy markets are higher following Wednesday’s reversal lower as bargain hunting kicks in ahead of Trump’s deadline for a ceasefire between Russia and Ukraine. It remains unclear if secondary tariffs on Russian energy purchasing countries would have any impact, or if the threat will result in India (following Trump’s announcement of additional 25% tariffs on them due to their purchases of Russian oil) looking for alternate sources. That appears to be supporting values after the recent selloff as the latter outcome would be expected to use up a good portion of the planned OPEC+ production increase set to take effect Sept. 1. September crude oil is $.55 per barrel higher at $64.90.

The Sept Canadian dollar is up .00060 at $.72975. The Brazilian real is down .00020 at .18170. December gold is up $11.50 per ounce at $3444.90.

OILSEEDS:

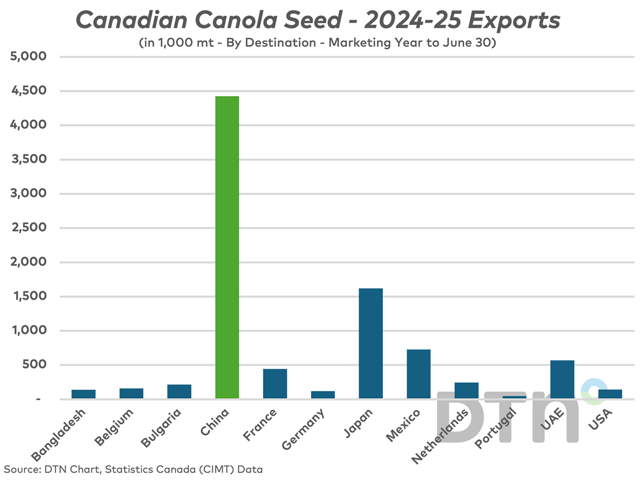

Canola is quietly higher in a reversal from an extension of recent selling seen overnight. With it now $9/mt off the lows, it may be a sign that the recent selling pressure has run its course. Continued profit taking in soybean oil has been too much to ignore with the same seen in canola this week. Technically speaking, this week’s dip below the July reaction low has negated the buy signal on the daily chart. A second one is setting up but will need to have improved market action soon to trigger. The current test of the 100-day moving average needs to hold as well. November canola is $1.90 higher at $671.60/mt.

Palm oil is lower, tracking recent soybean oil losses. The September contract is down .59%.

Soybean oil is slightly weaker as the bulls have not had enough confidence that the profit taking correction has run its course to step in. Wednesday’s late day selloff in crude oil did not help nor did the overnight’s partial recovery. Technically speaking, the breakaway gap that was left on the daily and weekly continuation charts in mid-June remains, still suggesting a leg up from the saucer bottom that’s been years in the making remains the primary technical influence.

European rapeseed is unchanged, trading within its recent range. November rapeseed is at 469.75 euros per mt.

Soybeans are quietly higher after succumbing to the widespread bearish psychology plaguing the ag markets Wednesday. Concerns over trade tensions with China that have resulted in a complete lack of new crop purchases to date likely weigh more heavily than record private yield estimates. That said, new crop sales are only running about 18 million bushels (mb) behind last year’s pace while USDA expects a 120-million-bushel year-over-year decline due to the need for increased soybean crush amid limited supply. The heat forecast for mid-August may be relatively short lived as it moves east later in the month. Depending on moisture, it may not have a significant impact on yield if that is the case.

WHEAT:

Wheat markets are higher in early trade as funds may finally be satisfied with gains on their short positions and begin to take profits. There are plenty of areas of production around the world to be concerned about if they want to, but we have seen this before. Time will tell if the recovery turns into anything more meaningful. Friday’s COT report confirmed that between Chicago and Kansas wheat markets, managed money traders had been adding to their short positions again ahead of the July 29 cutoff. They were net short 112,604 contracts or 563 mb. Short covering by this group is likely the best hope for any meaningful rally.

CORN:

Corn is quietly higher but already $.08/bushel above Wednesday’s low as bargain hunting and short covering may have finally kicked in. With prices nearing last August lows, the seasonal trade of selling at 50% seeded and cover in August about run its course and peak optimism over production potentially behind us given pollination issues, a bottom here certainly would make sense. Technically speaking, a spike down below the July low with a quick recovery would likely leave a divergence bottom on long-term charts if it occurs (but it will take the Friday close to know). If so, filling the gap down from July 7 with a rally to $4.33/bushel would be a reasonable goal. Regarding market participants, Friday’s COT report confirmed that managed money traders were light sellers amid the pollination debate, taking them to 181,185 contracts or 906 mb net short. A covering event from this group would be expected to boost prices, should yield concerns eventually inspire it.

For greater detail on factors impacting soybean, wheat and corn markets — see DTN’s “Before the Bell” comments released shortly after 8 a.m. CDT.